life insurance face amount and death benefit

2022s Lowest Life Insurance Costs Online. If the face amount of the policy is 1000000 your death benefit would be the following depending on which option you selected.

/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Variable Life Vs Variable Universal What S The Difference

Get Fully Covered By Top Providers Today.

. A 500000 policy therefore has a face value of 500000. However the maximum amount available will vary by life insurance carrier usually from 75 to 95 of the death benefit. Life Insurance Face Amount - If you are looking for the best life insurance quotes then look no further than our convenient service.

Decreasing term level term and permanent life insurance. Simply put the life insurance face value also called the death benefit is the amount that your beneficiary will receive when you die. The face value never changes.

So if you buy a policy with a. If based on your face amount plus the cash value of your account. What should the face value of your life insurance policy be.

Typically the insurance company sets a maximum benefit amount based on life expectancy and the policyholder makes the final decision on how much of an advance from their life insurance policy death benefit they need to meet. Graded benefit policy. Life insurance cash value is accessible to the policy owner in various ways depending on the policy.

In all cases life insurance face value is the amount of money given to the beneficiary when the policy expires. Ad Help protect your loved ones with valuable term coverage up to 150000. How the Face Value of Life Insurance Works.

1150000 1000000 150000. Your insurance company will be able to give you the exact rate you will pay if you decide to decrease your death benefit. However as time goes by they can begin to diverge.

Look No Further - We Compared The Best Companies. Level term life insurance pays a set death benefit throughout the coverage term. The face amount and thereby the death benefit can change for a number of reasons but it is much more difficult to increase a death benefit substantially than to decrease it in most circumstances.

If based on your face amount. Face amount life insurance definition industrial life insurance face amounts face amount of policy face amount meaning life insurance face value what is face amount face amount vs cash value life insurance face amount meaning Publishers do a. It remains at the same level from the beginning of the insurance contract until the end.

This is in contrast to decreasing term life insurance in which the coverage amount or death benefit decreases throughout the term. Rates starting at 11 a month. The face value is the death benefit.

The exact face value of your life insurance policy will depend on how much coverage you bought. They both reflect the amount of money that the insurance company will pay out in the case of a valid claim. At the beginning of the policy the face value and the death benefit are the same.

If you purchase a policy for 100000 for example that amount is the face value of your policy and thats the amount that your beneficiaries will receive if you should die while the policy is in effect. Decreasing Term Insurance Policies. The first step in figuring out the face value of your plan is visiting your benefits schedule.

When buying guaranteed issue life insurance or a graded benefit plan your face amount on the application pays a different death amount if you die within two years after purchasing the policy. This is the dollar amount that the policy owners beneficiaries will receive upon the death of the insured. When a life insurance policy is identified by a dollar amount this amount is the face value.

There are three main types of life insurance policies. Therefore if you were to buy a policy with a 1 million dollar death benefit your beneficiary will receive 1 million upon your death. If the policyowner dies.

For instance if you bought 10000 in face amount and died six months later your beneficiaries will collect the amount of paid premiums plus 10 in. Ad Know the Difference Between Term Life and Whole Life Insurance and Learn Which is Better. Its the amount of death benefit purchased which indicates the amount of money the policy will pay to the beneficiary or beneficiaries when the insured person dies.

The reasons for a change in the death benefit can include additional paid-up insurance bought with dividends and having an increasing death benefit based on the cash. A life insurance policy has a face value and a cash value and they are two different numbers. The face value is typically how much your life insurance beneficiaries will receive if you die while your policy is in force.

Life Insurance Death Benefit vs Cash Value. The death benefit of a life insurance policy is the amount paid out upon the death of the insured while cash value refers to the amount of funds in a permanent life insurance policys cash account. Confidently Know Youre Doing the Best for Your Family.

Decreasing term life insurance provides coverage for a set period of time. It can also be referred to as the death benefit or the face amount of life insurance. If you bought 1 million in life insurance coverage your policys face value is 1 million which is also how much your beneficiaries will receive if you die while your policy is active.

This figure is recorded in the schedule of benefits for the policy. Ad Wonder How Much Does Life Insurance Cost. See your rate and apply now.

Level term policies are perhaps the most popular type of life insurance policies due to their affordability and flexibility.

/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Variable Life Vs Variable Universal What S The Difference

What Is Whole Life Insurance And How Does It Work Lincoln Heritage

:max_bytes(150000):strip_icc()/dotdash-090816-cash-value-vs-surrender-value-what-difference-final-b2df392375e34caf9eac4e7bc2648283.jpg)

Cash Value Vs Surrender Value What S The Difference

Life Insurance Life Insurance Marketing Ideas Life Insurance Facts Life Insurance Sales

Cash Value And Cash Surrender Value Explained Life Insurance

Life Insurance Loans A Risky Way To Bank On Yourself

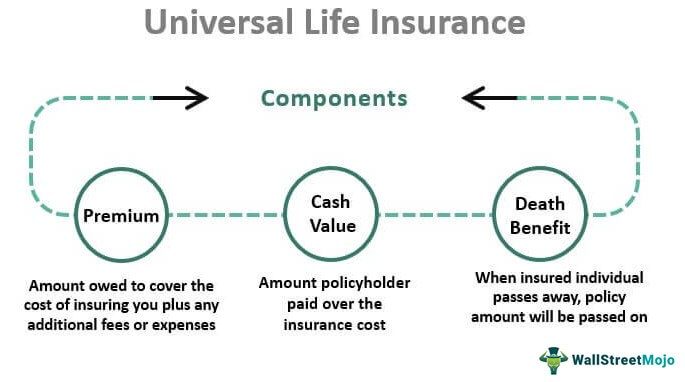

Universal Life Insurance Definition Explanation Pros Cons

Cash Value And Cash Surrender Value Explained Life Insurance

Cash Value And Cash Surrender Value Explained Life Insurance

/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Variable Life Vs Variable Universal What S The Difference

What Are Paid Up Additions Pua In Life Insurance

How To Buy A 1 Million Life Insurance Policy And When You Need It

:max_bytes(150000):strip_icc()/lifeinsurance-v32-8e01fd19793a49699e47973cfdf98f3d.png)

Life Insurance Guide To Policies And Companies

What S An Irrevocable Life Insurance Trust Local Life Agents